In this post, we will discuss how to download dividend information for stocks in Excel for free.

This excel macro returns the following key metrics related to dividend.

- Historical Dividend Data

- Forward Annual Dividend Rate

- Forward Annual Dividend Yield

- 5 Year Average Dividend Yield

- Trailing Annual Dividend Rate

- Trailing Annual Dividend Yield

- Payout Ratio

- Ex-Dividend Date

- Go to the folder where the downloaded macro file is located.

- Right-click the file and choose Properties from the menu.

- At the bottom of the General tab, select the Unblock checkbox under security option and then click OK.

- Open the file and specify the start and end dates in cells B4 and B5.

- Enter the tickers (symbols) of the stocks for which you want dividend information, starting from cell A8.

- Press the "Get Historical Data" button to import past dividend details for each stock.

- Press the "Summary" button to import key dividend metrics for each stock.

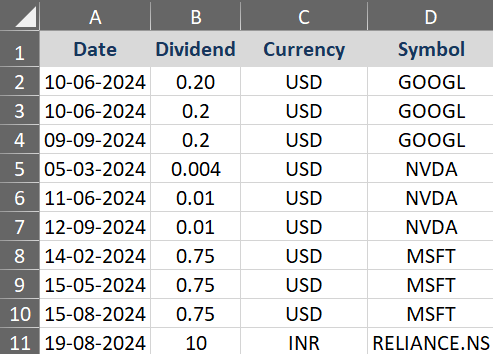

Historical Dividend Data

Historical data including dividends and dividend dates will be provided for the period between these dates. Please note that the end date is not included in the range.

After clicking on the Get Historical Data button, dividend data will be downloaded from yahoo finance and will appear in the "HistoricalData" sheet tab.

This macro returns dividend information for hundreds of thousands of stocks from 48 countries. It is important to follow the ticker format used by Yahoo Finance. For US stocks, you just need to specify tickers. Whereas, for non-US stocks, you need to add suffix as shown in the table below.

Example : The ticker for Volkswagen is VOW. So we need to input VOW.DE as 'DE' refers to the exchange in Germany.

| Market | Exchange | Suffix |

|---|---|---|

| Argentina | Buenos Aires Stock Exchange (BYMA) | .BA |

| Austria | Vienna Stock Exchange | .VI |

| Australia | Australian Stock Exchange (ASX) | .AX |

| Belgium | Euronext Brussels | .BR |

| Brazil | Sao Paolo Stock Exchange (BOVESPA) | .SA |

| Canada | Canadian Securities Exchange | .CN |

| Canada | NEO Exchange | .NE |

| Canada | Toronto Stock Exchange (TSX) | .TO |

| Canada | TSX Venture Exchange (TSXV) | .V |

| Chile | Santiago Stock Exchange | .SN |

| China | Shanghai Stock Exchange | .SS |

| China | Shenzhen Stock Exchange | .SZ |

| Czech Republic | Prague Stock Exchange Index | .PR |

| Denmark | Nasdaq OMX Copenhagen | .CO |

| Egypt | Egyptian Exchange Index (EGID) | .CA |

| Estonia | Nasdaq OMX Tallinn | .TL |

| Europe | Euronext | .NX |

| Finland | Nasdaq OMX Helsinki | .HE |

| France | Euronext Paris | .PA |

| Germany | Berlin Stock Exchange | .BE |

| Germany | Bremen Stock Exchange | .BM |

| Germany | Dusseldorf Stock Exchange | .DU |

| Germany | Frankfurt Stock Exchange | .F |

| Germany | Hamburg Stock Exchange | .HM |

| Germany | Hanover Stock Exchange | .HA |

| Germany | Munich Stock Exchange | .MU |

| Germany | Stuttgart Stock Exchange | .SG |

| Germany | Deutsche Boerse XETRA | .DE |

| Greece | Athens Stock Exchange (ATHEX) | .AT |

| Hong Kong | Hong Kong Stock Exchange (HKEX)*** | .HK |

| Hungary | Budapest Stock Exchange | .BD |

| Iceland | Nasdaq OMX Iceland | .IC |

| India | Bombay Stock Exchange | .BO |

| India | National Stock Exchange of India | .NS |

| Indonesia | Indonesia Stock Exchange (IDX) | .JK |

| Ireland | Euronext Dublin | .IR |

| Israel | Tel Aviv Stock Exchange | .TA |

| Italy | EuroTLX | .TI |

| Italy | Italian Stock Exchange | .MI |

| Japan | Tokyo Stock Exchange | .T |

| Latvia | Nasdaq OMX Riga | .RG |

| Lithuania | Nasdaq OMX Vilnius | .VS |

| Malaysia | Malaysian Stock Exchange | .KL |

| Mexico | Mexico Stock Exchange (BMV) | .MX |

| Netherlands | Euronext Amsterdam | .AS |

| New Zealand | New Zealand Stock Exchange (NZX) | .NZ |

| Norway | Oslo Stock Exchange | .OL |

| Portugal | Euronext Lisbon | .LS |

| Qatar | Qatar Stock Exchange | .QA |

| Russia | Moscow Exchange (MOEX) | .ME |

| Singapore | Singapore Stock Exchange (SGX) | .SI |

| South Africa | Johannesburg Stock Exchange | .JO |

| South Korea | Korea Stock Exchange | .KS |

| South Korea | KOSDAQ | .KQ |

| Spain | Madrid SE C.A.T.S. | .MC |

| Saudi Arabia | Saudi Stock Exchange (Tadawul) | .SAU |

| Sweden | Nasdaq OMX Stockholm | .ST |

| Switzerland | Swiss Exchange (SIX) | .SW |

| Taiwan | Taiwan OTC Exchange | .TWO |

| Taiwan | Taiwan Stock Exchange (TWSE) | .TW |

| Thailand | Stock Exchange of Thailand (SET) | .BK |

| Turkey | Borsa İstanbul | .IS |

| United Kingdom | London Stock Exchange | .L |

| Venezuela | Caracas Stock Exchange | .CR |

Note : The macro returns NA if no data is found on Yahoo Finance.

Key Dividend Metrics

Key statistics related to dividends are downloaded from Yahoo Finance when you click on the "Summary" button in Excel.

- Forward Annual Dividend Rate : The total dividends a company is expected to pay in a year based on its current payout.

- Forward Annual Dividend Yield : The expected annual dividend divided by the current stock price in terms of percentage.

- 5 Year Average Dividend Yield : The average yield of a company's dividends over the past five years.

- Trailing Annual Dividend Rate : The total dividends a company actually paid in the past one year.

- Trailing Annual Dividend Yield : The actual annual dividends paid divided by the stock price in the past one year.

The following VBA code is used to fetch historical dividend data from Yahoo Finance into Excel.

Sub GetData()

Dim InputControls As Worksheet

Dim OutputData As Worksheet

Dim symbol As String

Dim startDate As String

Dim endDate As String

Dim last As Double

Dim OffsetCounter As Double

Dim result As Integer

Dim rng As Range

Application.ScreenUpdating = False

Application.DisplayAlerts = False

Application.Calculation = xlCalculationManual

'Sheet Names

Set InputControls = Sheets("Inputs")

Set OutputData = Sheets("HistoricalData")

With InputControls

last = .Cells(.Rows.Count, "A").End(xlUp).Row

End With

' Arguments

startDate = (InputControls.Range("B4") - dateValue("January 1, 1970")) * 86400

endDate = (InputControls.Range("B5") - dateValue("January 1, 1970")) * 86400

period = "1d"

Dateminus = -InputControls.Range("B4") + InputControls.Range("B5")

If InputControls.Range("B5") > Date Then

result = MsgBox("EndDate seems greater than today's date. Okay to you?", vbYesNo, "Validate End Date")

If result = vbNo Then

Exit Sub

End If

End If

If Dateminus < 1 Then

MsgBox ("Date difference must be atleast one. Since EndDate is not inclusive of the date, you can have one day difference between start and end Date to fetch latest price")

Exit Sub

End If

OutputData.Range("A2:H1000000").ClearContents

'Loop over multiple symbols

For i = 8 To last

symbol = InputControls.Range("A"& i).value

OffsetCounter = 1

Call ExtractData(symbol, startDate, endDate, OffsetCounter, OutputData)

Next i

Set rng = OutputData.Range("A:D") ' Change as needed to target specific rows

rng.RemoveDuplicates Columns:=Array(1, 3, 4), Header:=xlYes

Application.Calculation = xlCalculationAutomatic

OutputData.Select

End Sub

Sub ExtractData(Symbols As String, startDate As String, endDate As String, OffsetCounter As Double, OutputData As Worksheet)

Dim resultFromYahoo As String

Dim objRequest As Object

Dim tickerURL As String

Dim combinedData As Variant

' Construct the API URL for the ticker

tickerURL = "https://query1.finance.yahoo.com/v8/finance/chart/"& Symbols & _

"?events=capitalGain%7Cdiv%7Csplit&formatted=true&includeAdjustedClose=true&interval=1d&period1="& startDate & _

"&period2="& endDate

' Fetch data from the API

Set objRequest = CreateObject("WinHttp.WinHttpRequest.5.1")

With objRequest

.Open "GET", tickerURL, False

.send

.waitForResponse

resultFromYahoo = .responseText

End With

' Call the ExtractDividends function to get the data

combinedData = ExtractDividends(resultFromYahoo, Symbols)

' Check if no dividends were found

If Not IsEmpty(combinedData) And VarType(combinedData) = vbString Then

OutputData.Cells(OutputData.Cells(Rows.Count, 1).End(xlUp).Row + OffsetCounter, 1).value = "NA"

OutputData.Cells(OutputData.Cells(Rows.Count, 2).End(xlUp).Row + OffsetCounter, 2).value = "NA"

OutputData.Cells(OutputData.Cells(Rows.Count, 3).End(xlUp).Row + OffsetCounter, 3).value = "NA"

OutputData.Cells(OutputData.Cells(Rows.Count, 4).End(xlUp).Row + OffsetCounter, 4).value = Symbols

ElseIf IsArray(combinedData) Then

' Output the dividends to the sheet

OutputData.Range("A"& OutputData.Cells(Rows.Count, 1).End(xlUp).Row + OffsetCounter).Resize(UBound(combinedData, 1), UBound(combinedData, 2)).value = combinedData

End If

End Sub

Function ExtractValue(ByVal json As String, ByVal startTag As String, ByVal endTag As String, Optional ByVal startPos As Long = 1) As String

Dim startPosTag As Long

Dim endPosTag As Long

Dim extractedValue As String

' Find the start position of the value

startPosTag = InStr(startPos, json, startTag)

' If the start tag is not found, return an empty string

If startPosTag = 0 Then

ExtractValue = ""

Exit Function

End If

' Adjust startPosTag to point to the actual value

startPosTag = startPosTag + Len(startTag)

' Find the end position of the value

endPosTag = InStr(startPosTag, json, endTag)

' If the end tag is not found, return an empty string

If endPosTag = 0 Then

ExtractValue = ""

Exit Function

End If

' Extract the value between the start and end tags

extractedValue = Mid(json, startPosTag, endPosTag - startPosTag)

ExtractValue = Trim(extractedValue)

End Function

Function ExtractDividends(ByVal json As String, ByVal symbol As String) As Variant

Dim result() As Variant

Dim dividendsSectionStart As Long

Dim dividendsSectionEnd As Long

Dim position As Long

Dim amountValue As String

Dim dateValue As String

Dim nColumns As Long

Dim numEntries As Long

Dim entryIndex As Long

Dim currentDividendStart As Long

Dim currentDividendEnd As Long

' Find the start of the "dividends" section

dividendsSectionStart = InStr(json, """dividends"":{")

If dividendsSectionStart = 0 Then

ExtractDividends = "No dividends found."

Exit Function

End If

' Find the end of the "dividends" section

dividendsSectionEnd = InStr(dividendsSectionStart, json, "}}")

If dividendsSectionEnd = 0 Then

ExtractDividends = "No dividends found."

Exit Function

End If

position = dividendsSectionStart

entryIndex = 1

numEntries = 0

' Count the number of entries

Do

currentDividendStart = InStr(position, json, "{") ' Move to the next opening brace

If currentDividendStart = 0 Or currentDividendStart >= dividendsSectionEnd Then Exit Do

numEntries = numEntries + 1

position = InStr(currentDividendStart + 1, json, "{") ' Move to the next opening brace for the next entry

Loop

' Redimension the array to store the results (3 columns: date, amount, symbol)

nColumns = 4

ReDim result(1 To numEntries, 1 To nColumns)

' Reset position to extract data

position = dividendsSectionStart

' Loop through each dividend entry

For entryIndex = 1 To numEntries

' Find the next opening brace for the current entry

currentDividendStart = InStr(position, json, "{")

If currentDividendStart = 0 Or currentDividendStart >= dividendsSectionEnd Then Exit For

' Extract the date value

position = InStr(currentDividendStart, json, """date"":") ' Find the date key

If position = 0 Or position >= dividendsSectionEnd Then Exit For

dateValue = ExtractValue(json, """date"":", "}", position)

' Extract the amount value

position = InStr(currentDividendStart, json, """amount"":") ' Find the amount key

If position = 0 Or position >= dividendsSectionEnd Then Exit For

amountValue = ExtractValue(json, """amount"":", ",", position)

' Store the date, amount, and symbol in the result array

result(entryIndex, 1) = Format(CDate(CDbl(dateValue) / 86400 + DateSerial(1970, 1, 1)), "yyyy-mm-dd")

result(entryIndex, 2) = amountValue

result(entryIndex, 3) = ExtractValue(json, """currency"":""", """")

result(entryIndex, 4) = symbol ' Add the symbol to the third column

' Move position to the next entry for the next loop

position = InStr(currentDividendStart + 1, json, "{") ' Move to the next opening brace for the next loop

Next entryIndex

ExtractDividends = result

End Function